This is a list of the properties that Chi Equities has acquired. The background and numbers provided are not indicative or guaranteeing any future performance or methodology by Chi Equities. They are solely provided as an example of the returns that have been achieved by Chi Equities.

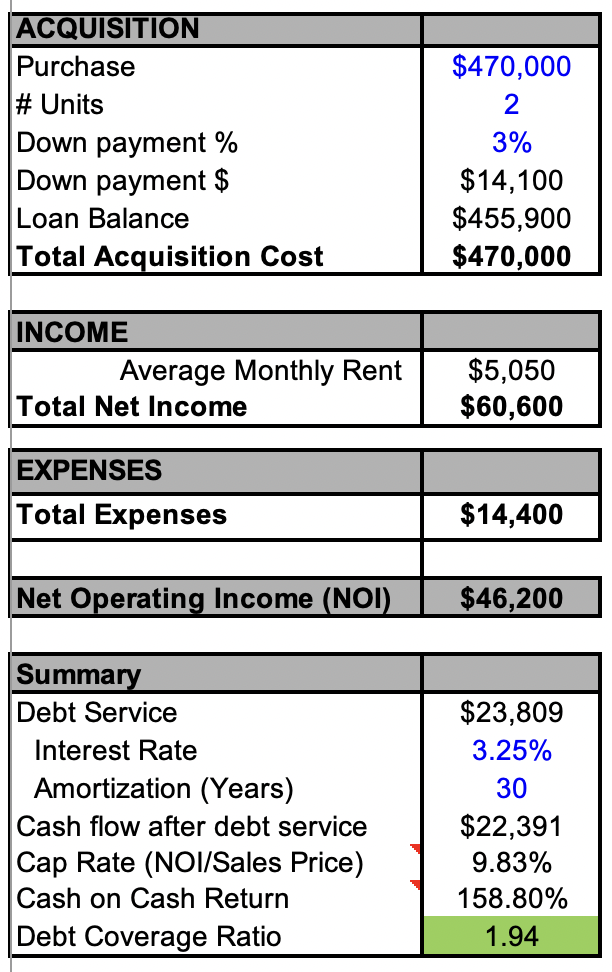

2-Unit Residential (Lakeview)

Louie acquired his first property located in Lakeview. It was purchased using a 203k loan, which finances both the purchase and complete renovation of the property. It was a total gut rehab down to the studs and proved to be an extensive project. However, with Louie’s experience in construction, he was able to supervise and contract the jobs out himself. The property was purchased for $345,000, with additional renovation capital of $125,000, totaling $470,000. Once completed, the property was re-appraised for $680,000. With this $210,000 increase in equity, Louie was able to pull a Home Equity Line of Credit (HELOC) which he then used to purchase his next property.

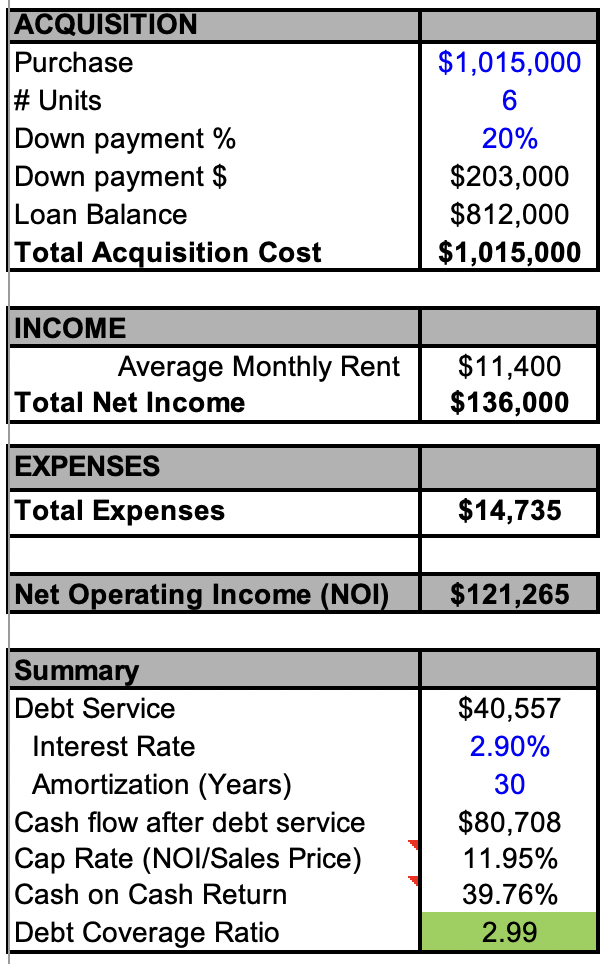

6-Unit Multifamily (Humboldt Park)

Chi Equities’ second deal was originally acquired as a five-unit apartment building located in the up-and-coming Humboldt Park neighborhood. This property was fully renovated by the previous owner in 2017, therefore requiring minimal maintenance and repairs upon purchase. This building also had an additional unfinished ground unit totaling 1,400ft2 that was being used only for storage. Chi Equities completed this final unit bringing the total to six, which is bringing in an additional $1,800 in rental income monthly. Originally the property was purchased for $1,015,000. With rental increases, the completion of the sixth unit, and other capital improvements, the property subsequently appraised at $1,300,000. Once again, this equity was used to help purchase the next property in the portfolio.

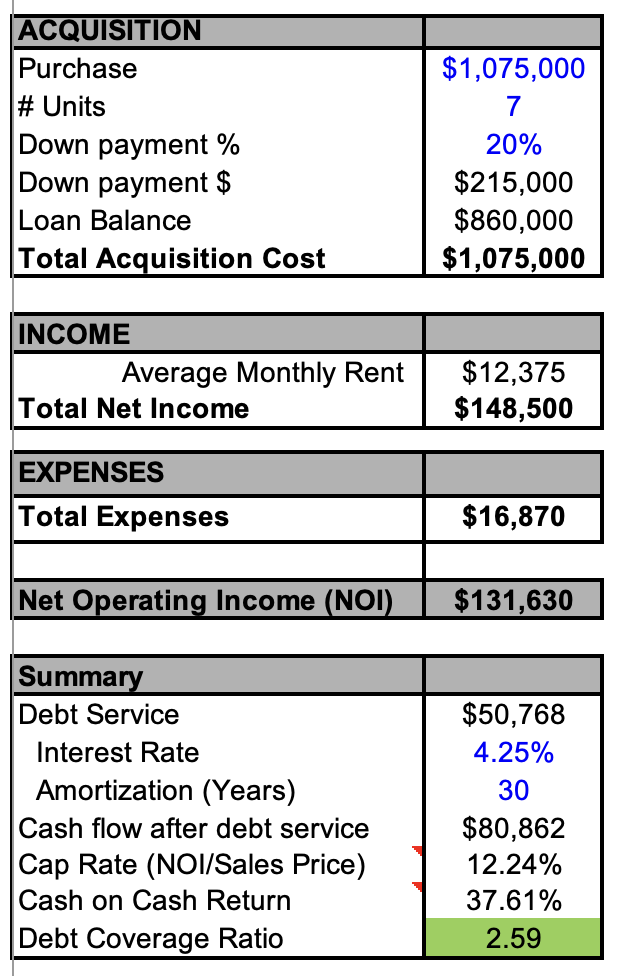

7-Unit Condo Deconversion (Humboldt Park)

Chi Equities’ third deal was a seven-unit deconversion also located in Humboldt Park. This property consisted of condo-quality units with minimal maintenance and cosmetic improvements needed. The property was purchased for $1,075,000. The condominiums and association were deconverted into apartments. Cosmetic improvements to the common areas and individual units were completed upon purchase. Chi Equities was able to raise rents an average of $400 per unit with capital improvements, bringing them to market value. This property recently appraised at $1,427,000, the equity of which will be used to go after another property.

4-Unit Mixed Use (Lincoln Park)

Chi Equities’ fourth deal is a four-unit mixed use property consisting of a storefront and three residential units. This is where we are headquartered, in the desirable Lincoln Park neighborhood. The value in this area will only continue to improve with the addition of Lincoln Yards a few blocks away. The office space was a total gut rehab to fit the aesthetic of the rest of the turnkey units. The property was purchased for $910,000 through an off-market deal. Appraisal value after repairs and full occupancy totaled $1,400,000. As with the other deals, this equity will be used in our next deal.